Nanomedicine: the application of nanotechnology in medicine is today one of the most promising and Market Growth rapidly growing sectors in healthcare. Japan, already a leader in biopharmaceutical and technology research, is now rapidly advancing in both the commercialization and application of nanomedicine. According to recent reports, the Japanese nanomedicine market was valued at approximately USD 7.82 billion in 2023 and is projected to reach USD 22.24 billion by 2030—representing a projected CAGR of approximately 16.1% between 2024 and 2030.

This rapid growth is not limited to Japan alonethe global nanomedicine market is also expanding rapidly. Global estimates indicate that this market was worth billions of dollars in 2023 and is on track to double in the next few years—meaning that international opportunities and partnerships for Japan will become even more extensive.

Key Drivers of Growth

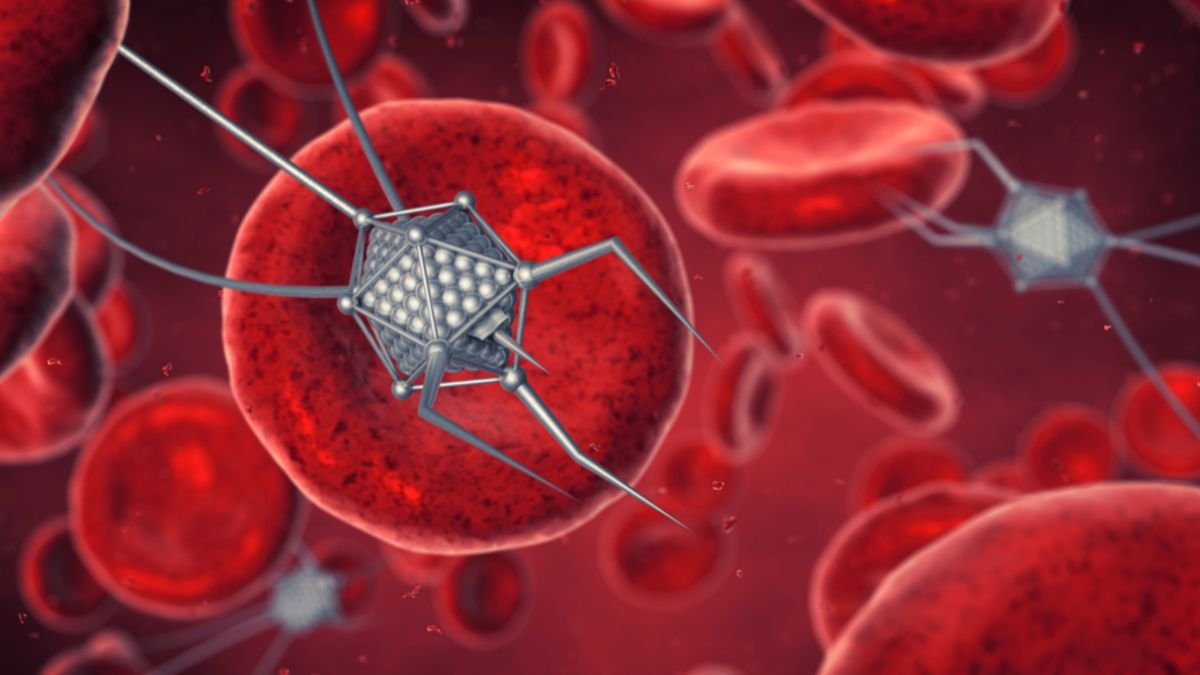

Advanced Drug Delivery Systems (Targeted Drug Delivery): Nanoparticles and liposomal systems have the ability to deliver drugs directly to targeted tissues—increasing drug efficacy and reducing side effects. Japanese pharmaceutical companies and research institutions are heavily investing in these technologies.

Increasing Biopharmaceutical R&D and Clinical Trials: Biotech startups and large pharmaceutical companies in Japan are advancing nanomedicine projects to the clinical trial stage—particularly in cancer therapy, immunotherapy, and targeted gene delivery. This is accelerating the flow of new products and licensing deals into the market. Aging Population and Rising Chronic Diseases: In advanced economies like Japan, the aging population and increasing prevalence of chronic diseases (cardiovascular, neurodegenerative, etc.) create a sustained demand for nanomedicine – as nanotherapies hold promise in the targeted treatment of these diseases.

Government Policy and Investment: The Japanese government and public-private initiatives are investing in nano-research, manufacturing, and regulatory guidance – accelerating the commercialization of the technology. Several reports indicate a surge in investment in the Asia-Pacific region, which is beneficial for Japan.

Key Segments and Fastest Growing Area

Nanomedicine is generally categorized into several key applications: Drug Delivery, Therapeutics, In-vitro Diagnostics, In-vivo Imaging, and Implants. In Japan, according to 2023 data, Drug Delivery was the largest revenue-generating segment, while Therapeutics (especially nanotherapies based on cancer and gene delivery) is projected to be the fastest-growing segment.

Furthermore, nanoformulations for diagnostics and imaging are also gaining rapid adoption – as nanoparticles enhance sensitivity, enabling early detection of diseases, which can improve treatment success rates.

Japanese Landscape: Opportunities and Challenges

Opportunities

- Industrial Clusters and Supply Chains: Japan has a robust ecosystem of high-quality manufacturing and pharmaceutical supply chains, which is favorable for nanomedicine production.

- Policy Support and Hospital-Level Partnerships: Collaboration with Japanese hospital networks and medical centers for co-clinical studies can shorten the path to market.

- Clinical Focus: Prioritized research and investment in oncology and rare diseases opens early-adoption pathways for pharmaceutical companies.

Challenges

- Regulatory Uncertainty: Specific regulatory frameworks for nano-products are still evolving—clear standards for safety, toxicology, and long-term effects are needed.

- High R&D Costs: The costs of raw materials, clean-room manufacturing, and clinical trials are substantial—a significant challenge for smaller startups.

- Public Acceptance and Ethical Questions: Addressing ethical concerns and risk perceptions associated with nano-drugs and gene delivery will be crucial.

Investment and Commercialization Strategies

Japanese companies and R&D institutions are adopting several key strategies to capitalize on rapid growth in the 2025–2030 timeframe:

- International Partnerships: Collaborations with foreign biotech companies, universities, and clinical networks for technology transfer and licensing.

- Manufacturing Onshoring: Investing in GMP-compliant nano-manufacturing units to ensure quality and supply stability.

- Step-wise Clinical Approach: Building brand value by first achieving clinical success in high-unmet-need diseases (such as certain cancer subtypes).

Market Size and Projections (Summary Statistics)

- Japan market (2023): ~USD 7.82 billion.

- Projected Japan market (2030): ~USD 22.24 billion (CAGR ~16.1% during 2024–2030).

Grand View Research - Global Context: The global nanomedicine market is also experiencing high double-digit growth—reports estimate a CAGR in the 11–13% range, reflecting strong growth in the Asia-Pacific region.

(Note: Figures and timelines may vary slightly across different market reports—but the trend is consistent: strong growth and high investment.)

Is this the next big investment opportunity?

In short—yes, but with careful consideration. Scientific advancements in nanomedicine, Japan’s infrastructure, and clinical needs are converging to create significant opportunities. However, due diligence is essential before investing, including verification of technical feasibility (proof-of-concept), clinical trial data, regulatory roadmap, and manufacturing capabilities. Strategic partnerships and phased milestone achievements will be crucial for startups.

Conclusion—2025–2030: Japan’s New Nano-Era

The 2025–2030 decade presents Japan with an opportunity for commercialization and global leadership in nanomedicine. Rapid R&D, clinical priorities, and a robust manufacturing interface will shape this market. Report-based projections suggest that the Japanese market has the potential to double or triple in the next five to six years—provided that regulatory and financial challenges are addressed in a timely manner.